The federal Fair Labor Standards Act (“FLSA”) and many states’ laws require employers to pay a minimum wage and overtime to all employees, unless some exemption applies. As an employer, one of your many responsibilities includes determining whether each of your employees qualifies for an exemption from these requirements. In common terms, employees who qualify for an exemption are “classified” as “exempt,” while those who don’t are “non-exempt.”

Although it sounds like a simple task, classifying employees is actually a complex matter that has far-reaching implications for your company as well as your employees. Improperly treating a non-exempt employee as exempt — commonly referred to as “misclassification” — can result in underpaying your people and expose your company to civil litigation, penalties, and other risks. That’s why it’s important to inform yourself and seek out professional counsel to correctly classify employees.

As a starting point, all employees are considered non-exempt unless they satisfy the applicable exemption requirements under state and federal law. Because non-exempt employees are afforded greater protections under the law, it is generally better to treat an employee as non-exempt when you’re not sure how they should be classified.

This post focuses on a particular set of exemptions under the FLSA that are known as the ‘white collar’ exemptions — each of which turns on facts surrounding the manner in which the employee is paid and their particular job duties. The FLSA has some other exemptions as well that are not covered here.

Employers should review applicable state law when determining whether an employee is exempt from minimum wage and overtime requirements.

Additionally, while most states with minimum wage and overtime requirements have exemptions that are similar to the FLSA’s white collar exemptions, the state laws may differ from the FLSA in ways that may result in a different classification outcome. Employers should review applicable state law when determining whether an employee is exempt from minimum wage and overtime requirements. If an employee is exempt under the FLSA, but non-exempt under applicable state law, the state law applies and they should be paid applicable minimum wage and overtime in accordance with the state law.

White Collar Exemptions — The Three Components

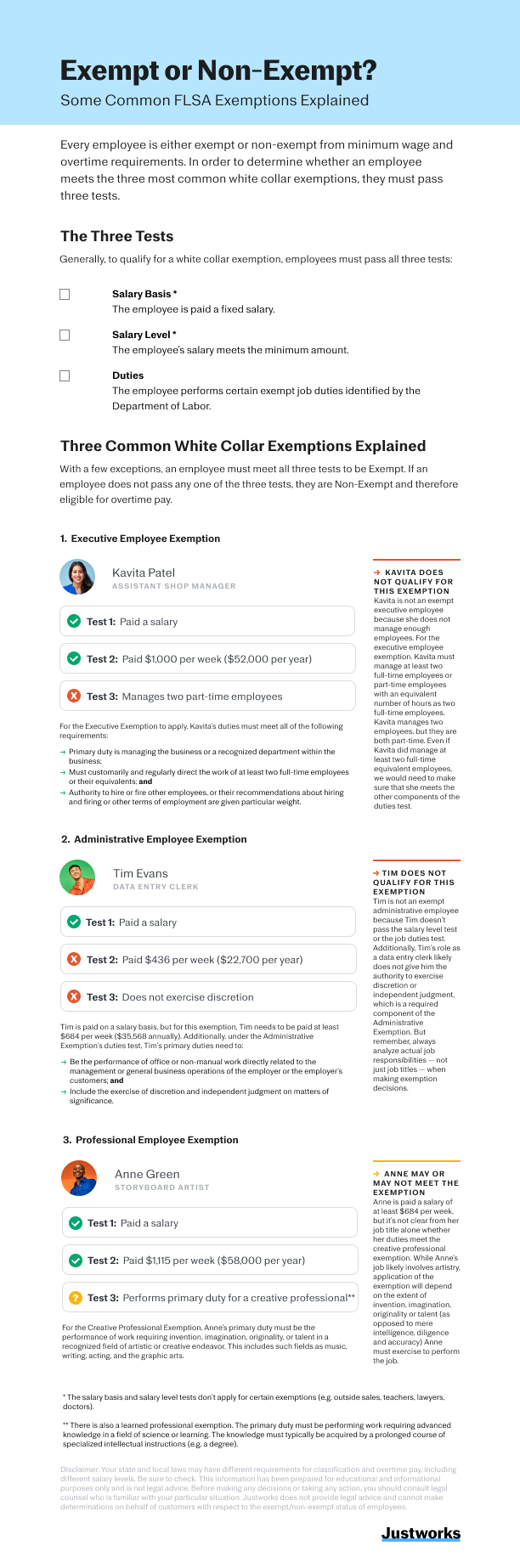

Under the FLSA, there are three common ‘white collar’ exemptions:

Each of these exemptions has three main components, all of which must be met for an employee to be exempt:

Salary basis test

Salary level test

Job duties test

Other ‘white collar’ exemptions include the “outside sales” and “computer” exemptions. These exemptions also include a job duties test, but the salary requirements are not the same.

A Closer Look at Each Test

The salary basis test is relatively straightforward. To qualify, an exempt employee must be paid a fixed salary. That means an exempt employee’s salary won’t reduce due to the quality or quantity of work they perform. However, even this test can be tricky, as improper deductions and other conduct may undermine the exemption.

For the salary level test, the current federal salary threshold is $684 per week ($35,568 annually). You can read more about this here. However, many state laws now have salary level tests that outpace the FLSA requirements.

The job duties test is arguably the most complex of the three. It also differs depending on which of the exemptions you apply: executive, administrative, professional, outside sales, or computer. For each exemption, qualified employees must have a primary duty that meets requirements set forth in the FLSA regulations. For some tests, there are multiple components to the primary duties test and the regulatory requirements may seem convoluted or subjective.

For some tests, there are multiple components to the primary duties test and the regulatory requirements may seem convoluted or subjective.

For example, for the administrative exemption to apply, the employee’s primary duty must be “the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers” and it must “include the exercise of discretion and independent judgment with respect to matters of significance.”

To help illustrate the requirements for the most common ‘white collar’ exemptions, we created the infographic below. It includes examples of how the job duties requirements for the executive, administrative, and professional employee exemptions may apply to an employee. You can learn more about who qualifies for these exemptions here.

Examples of Exempt or Non-Exempt Employees

If you’re looking for more resources, we’ve also made downloadable slides and Help Center articles explaining exempt classifications. And it’s always a good idea to consult legal counsel for guidance on the application of these exemptions under federal and state law to your situation.

Learn more with Justworks’ Resources

Scale your business and build your team — no matter which way it grows. Access the tools, perks, and resources to help you stay compliant and grow in all 50 states.