Justworks is excited to announce that you can now split your paycheck automatically on payday. This has been on our members’ wish list for some time, and we’re happy we can bring this feature to you.

What is Multi-Bank Account Deposit?

Multi-bank account deposit is the ability to split your paycheck directly into two different bank accounts via direct deposit.

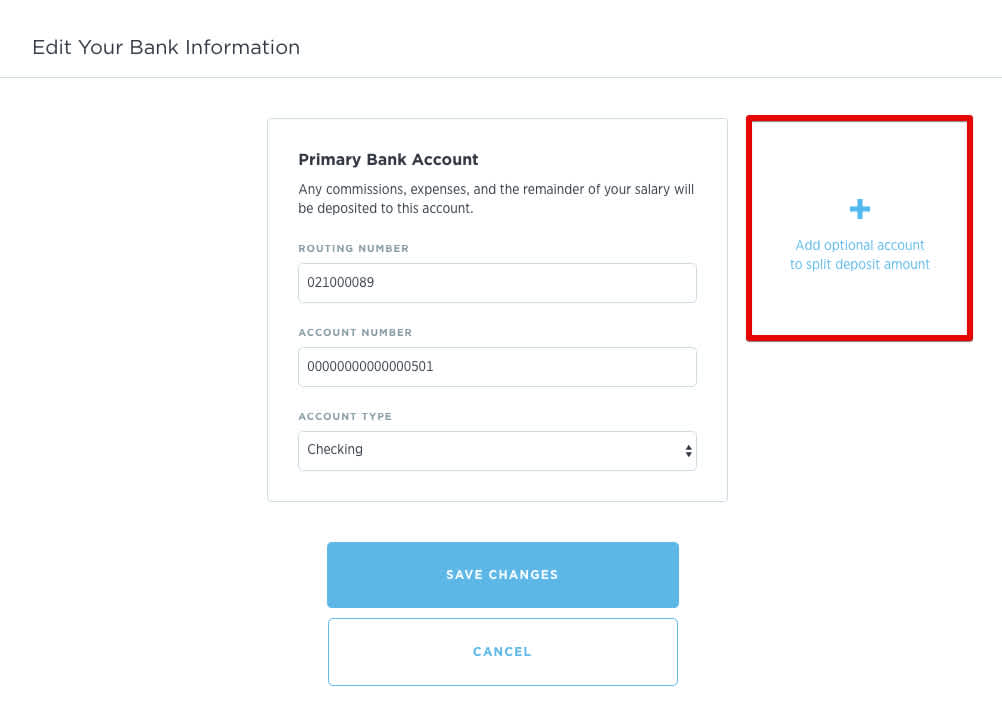

How Do I Add Multi-Bank Account Direct Deposit?

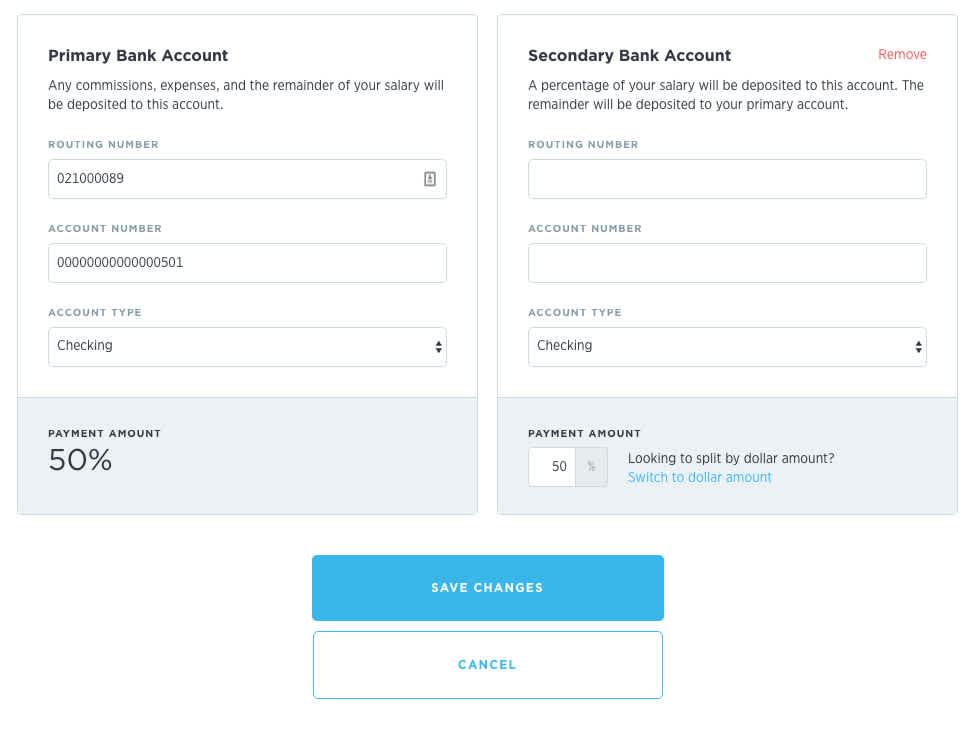

Add a second bank account by logging into Justworks and entering the account details.

Choose how much of each payment should be deposited into your secondary bank account by percentage or dollar amount. The remaining amount will be deposited into your primary bank account — this is the account all your payments currently go to.

All taxable payroll checks from your employer including salary, commission, bonus payments will be split based on the amount you select.

Non-taxable payments such as expense reimbursements will not be split and will be deposited 100% into your primary bank account.

Why Did Justworks Create This Feature?

Our customers requested direct deposit split into two accounts. It’s also a practical feature that will help you better manage your finances, avoid bank transfer fees, and meet savings goals.

What Else Should I Know?

As always, we’re available to answer any of your questions. You can reach us at 1-888-534-1711 or [email protected]. You can also check out our help center article for more details.

Learn more with Justworks’ Resources

Scale your business and build your team — no matter which way it grows. Access the tools, perks, and resources to help you stay compliant and grow in all 50 states.