Simple Online Payroll Software & Services

Flexible, reliable payroll solutions. Pay your team quickly with Justworks payroll software and services for small businesses.

Payroll You Can Count On

Paying your people is fast and easy with Justworks payroll software and services for small businesses. Simplify complex payroll tasks and schedule payments seamlessly to get time back for your business. With our integrations and add-on features, get a more tailored payroll experience that meets your business needs.

Simplify Your Online Payroll Process

Accurately pay your team — on time, every time — without breaking a sweat. Easily run payroll for hourly and salaried non-exempt employees across multiple states with weekly and bi-weekly pay frequencies. Never miss a pay period by setting up automated payroll and scheduling payments for contractors.

Stay efficient with the ability to:

- Set up notifications and reminders

- Complete flexible one-off payments for employees, contractors, vendors, or expense reimbursements.

Stay on Top of Compliance

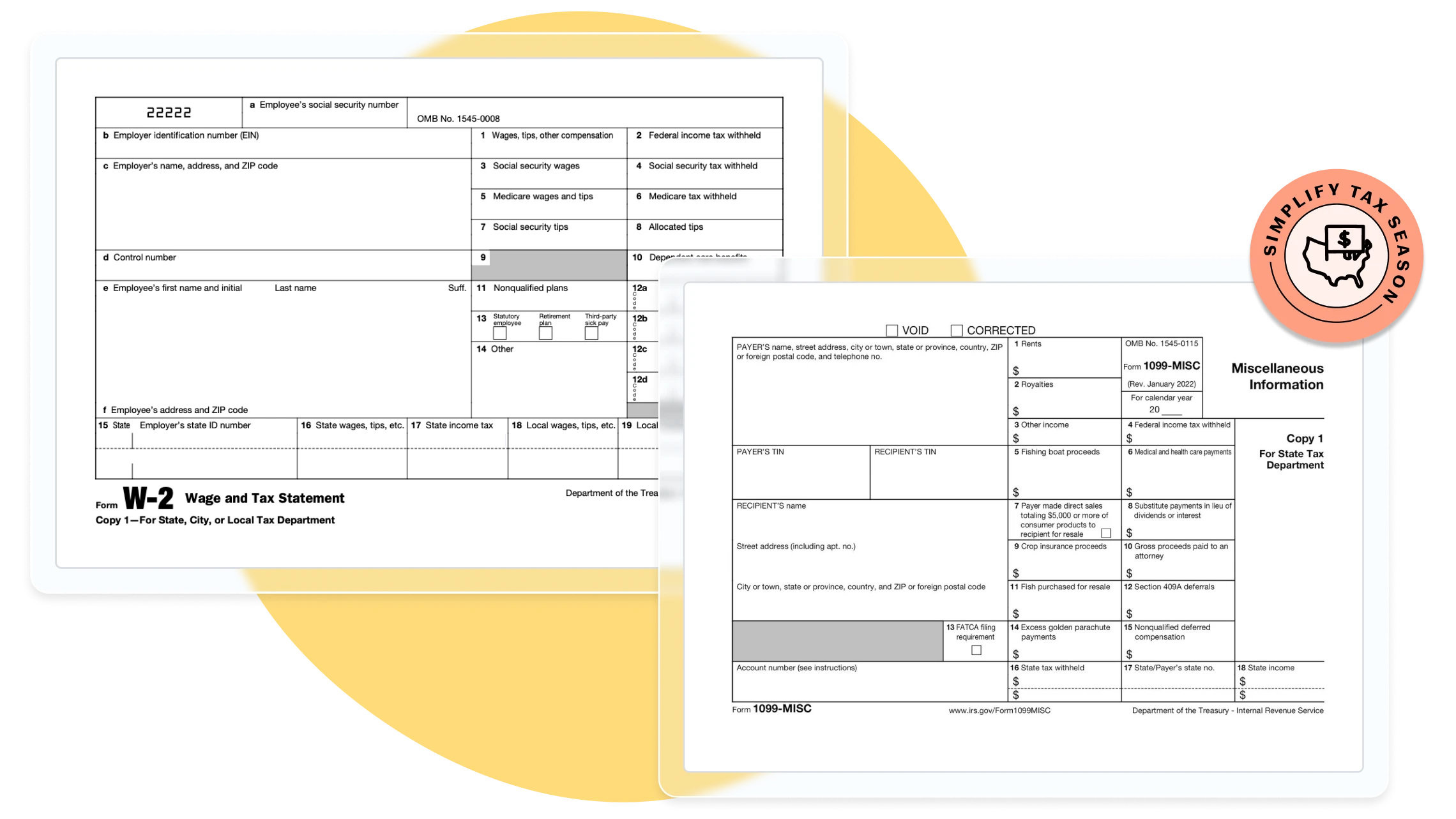

Take the stress out of tax season. Comply with payroll tax and employment regulations effortlessly with the help of Justworks' payroll software and services. Sit back while we file your payroll taxes (940s and 941s), W-2s, and 1099s without additional charges. Avoid future compliance headaches with compliance resources and access to our support team for any questions or guidance along the way.

Consolidate Your Financial Tools

Eliminate the need to switch constantly between different systems and services. Clear your to-do list and make your life easier with tools and seamless integrations in Justworks PEO and Justworks Payroll.

Manage online payroll from one place in Justworks PEO thanks to integrations with your favorite accounting software.

Save time by connecting your Justworks PEO account to Xero, QuickBooks Online, NetSuite, or Sage Intacct.

Close the books more quickly and save time with the Justworks Payroll Quickbooks Online integration.

Link your accounts once, and you’re ready to roll. Additional integrations coming soon!

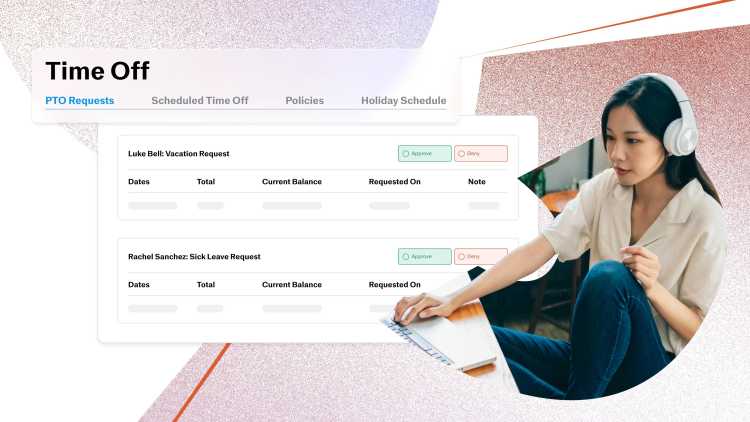

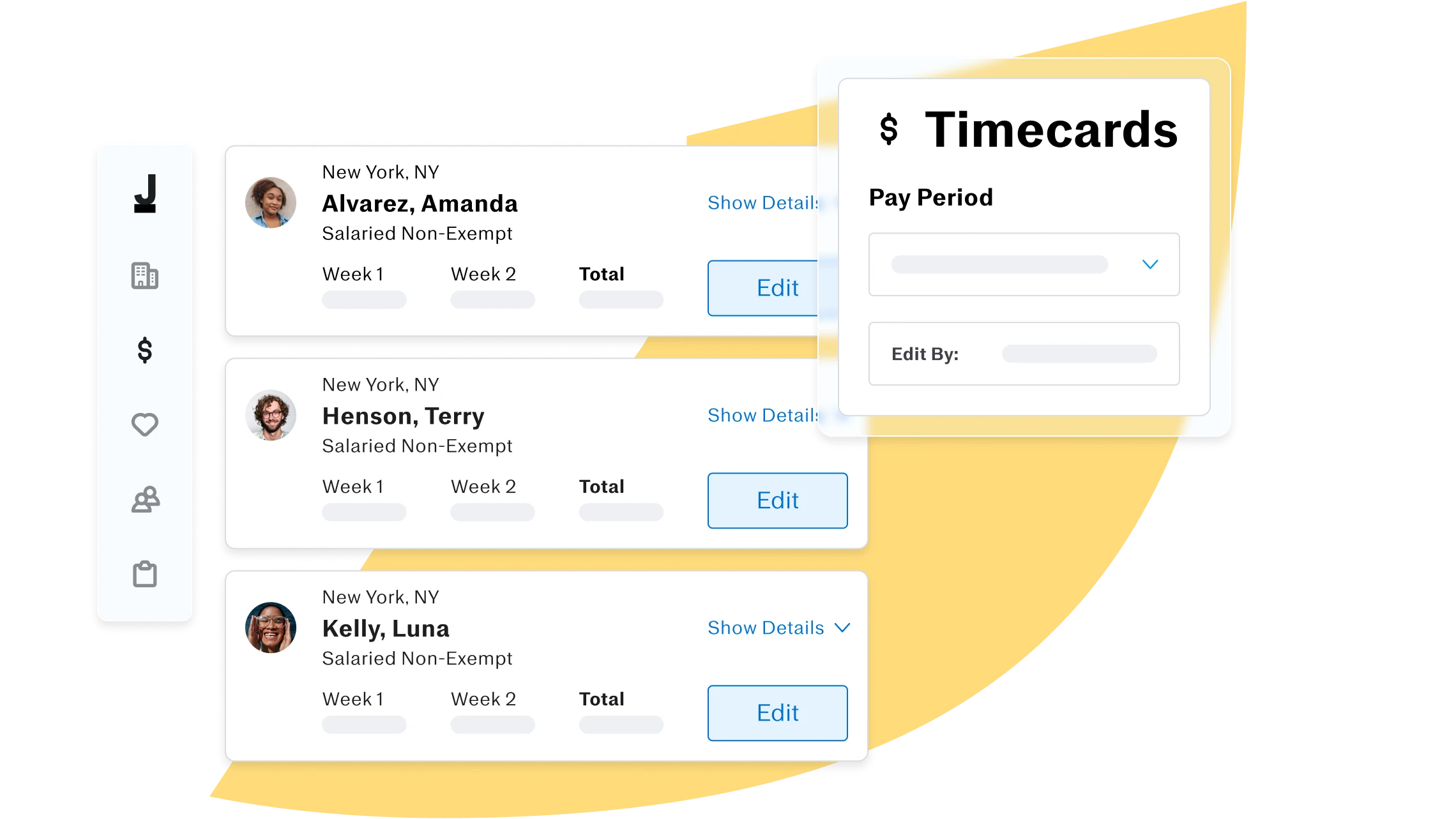

Easily Sync Timesheets To Payroll

Streamline payroll with robust time and attendance software that seamlessly connects timesheets to payroll with the addition of Justworks Time Tracking. Increase team accountability and run payroll confidently with a reliable timekeeping tool that’s easy for you and your employees to use.

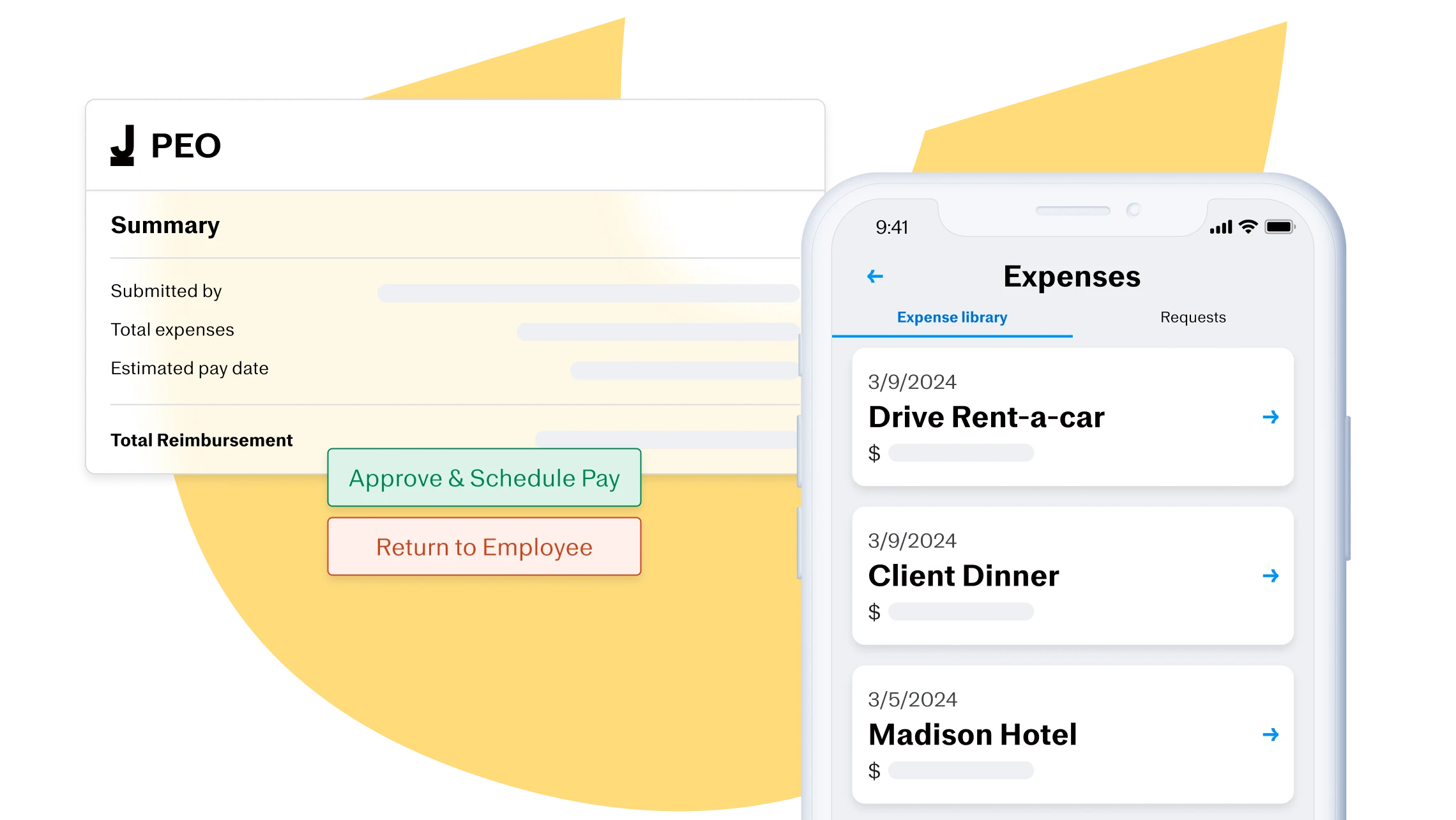

Streamline Expense Reimbursements

Simplify the process of reimbursing employees for out-of-pocket business costs with our Expenses tool built into the Justworks PEO platform. Minimize the risk of error and review, approve, and pay out expenses faster by setting automated workflows and flexible rules. With your payroll and expense data in one place, you’ll have one less tool to keep track of for more accurate financial reporting. Employees can also save time by submitting expenses online or on the go using the Justworks PEO mobile app.

Payday Made Paperless

With Justworks PEO employee payroll, employees get a ‘You got paid!’ email and push notification with the information they’ve elected to receive. They can also get paid across multiple bank accounts and access their payment details in their paystubs. And, with the Justworks PEO mobile app, employees can easily view, download, or share payment details in just a few simple taps.

“If I'm not spending time on payroll, and Justworks is taking care of that, I have more time for the things I'm good at and actually like to do.”

Sascha Meyer

Co-Founder, Mamava

Read the Case StudySee What Payroll Tools Justworks Offers

Explore the full functionality of Justworks payroll software and services across our PEO and Payroll platforms.

Justworks Payroll

- Set automatic direct deposit payroll for salaried & hourly employees

- Pay contractors

- Make one-off payments

- Integrate with QuickBooks Online

- Opt to track hours worked and sync to payroll with our Time Tracking integration

- Do everything on desktop or through our mobile-optimized platform

- Make payments across NY, CA, TX, FL, MA, IL, NJ, GA, NC, SC, NV, WI, TN, AZ, UT, LA, KS, OK, MT, SD, ME, ID, CO, VA, MD, CT, MN, NH, NE, IA, MI, VT, and DC

- Set up payment reminders

- File your W-2s, 1099s, and payroll taxes (940/941s)

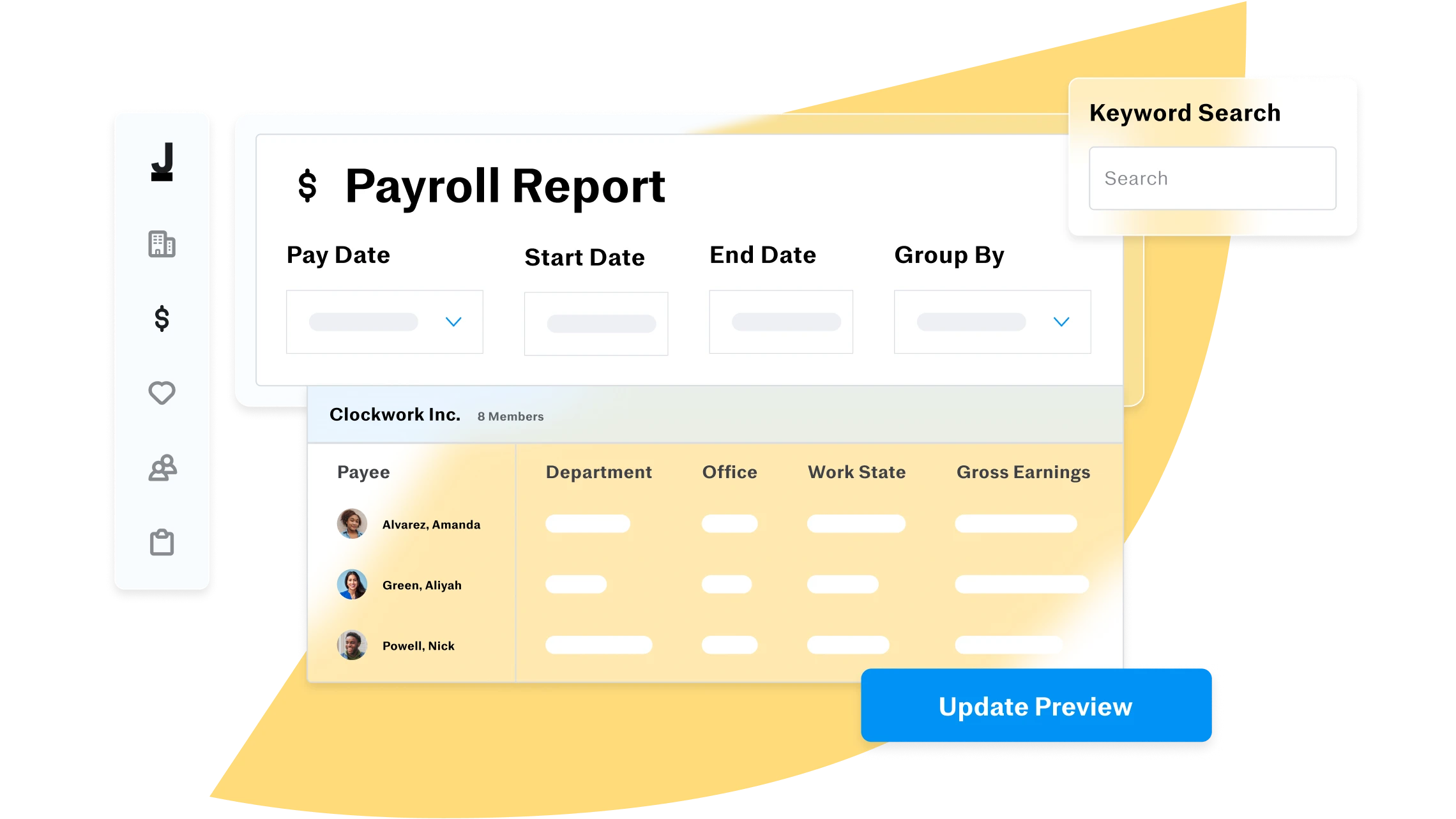

- Run payroll reports

- Fill out basic timecards

Justworks PEO

- Set automatic direct deposit payroll for salaried & hourly employees

- Make one-off payments

- Pay vendors and contractors

- Split direct deposits across multiple accounts

- Integrate with Xero, QuickBooks Online, NetSuite, and Sage Intacct

- Opt to track hours worked and sync to payroll with our Time Tracking integration

- Do everything online or view benefits, company calendar, access payments, and more with the Justworks PEO mobile app

- Make payments across all 50 states

- Set up payment reminders

- File your W-2s, 1099s, and payroll taxes (940/941s)

- Run payroll reports

- Fill out timecards

- Add the option to pay international contractors

- Streamline expense reimbursement with an expense management tool

Ready to Pay Your Team with Ease?

Start paying your team reliably and more easily with payroll software built for small businesses. Together we’ll build a plan that works for your business.