Skip the Manual Work of HR Admin

Focus on driving impact and leading your team to success. Justworks’ user-friendly software and services are designed to help you simplify complex processes with time to spare.

Team Management Made Easier

Streamline your day-to-day responsibilities with tools and resources from Justworks that can help you lead your team to success and empower your people to bring their best selves to work.

Consolidate your tech stack with tools and integrations we’ve built to streamline your workflow.

Streamline health insurance enrollment and employee benefits management.

Implement a timekeeping solution that makes accurately tracking time easier.

Save Time on HR Admin with Handy Integrations

Managing your people has never been easier with Justworks’ HR software. Get more done in less time from a single platform that helps you streamline day-to-day administrative tasks. Plus, navigate the constantly changing HR landscape confidently with expert guidance from our support team.

Fast & East Employee Onboarding

Our user-friendly interface makes getting employees set up in Justworks PEO or Justworks Payroll as simple as a few quick clicks. Your team can efficiently onboard through our user-friendly dashboard, from entering direct deposit details to choosing health insurance plans. Our integrations with leading applicant tracking systems like Greenhouse, JazzHR, and Lever, onboarding employees to Justworks PEO is faster, more efficient, and less error-prone.

No More Managing Unwieldy Spreadsheets

Close out the books faster using integrations with top accounting software. Justworks PEO offers integrations with Quickbooks Online, Xero, NetSuite, and Safe Intacct, while, Justworks Payroll offers access to Quickbooks Online. Once that’s set up, grant third-party access to accounting partners so they can get to work more efficiently.

Attract & Retain the Best Talent

Keep your whole team happy and healthy with great employee benefits that they’ll love. Competitive benefits increase your success in hiring and keeping those star players on your team.

Benefits Access for Teams of All Shapes & Sizes

Secure health insurance coverage for your team without compromising on value. Get more flexibility to select a plan that checks off all the boxes. Benefits access through Justworks Payroll or Justworks PEO gives you the ability to browse and compare plans or opt to carry over your existing plan.

Offer Your Team More

For a more robust benefits offering, Justworks PEO gives you access to a variety of large-group health insurance coverage through national and regional carriers. Pair that up with offering your team additional benefits like 401(k), mental health, primary care, fertility benefits, and more.

*Please note benefits and perks accessed through Justworks may vary by location and health insurance carrier. Please contact Justworks for more information about options available in your area.

Simplify Benefits Administration

Select plans and enroll in benefits more quickly and with fewer frustrations. Our intuitive, all-in-one platform makes navigating plan selection and enrollment more hands-off for you and less complicated for employees. Employees get support for benefits questions, which frees up your time. Your team can manage benefits within our platform, helping them get more value without the extra HR work.

- Company NeedsThe Water Project wanted to offer competitive benefits with an all-in-one time-saving solution.

- SolutionsWith Justworks PEO, they were able to access competitive benefits through a modern, tech-forward platform that helps streamline operations.

- ResultsThey were able to offer their employees great benefits and perks at fair rates saving them money and attracting talent as they grow.

“One of the things we value here at The Water Project is taking care of our employees. I felt like by moving to Justworks [PEO], we were able to do the right thing for the employees and the organization. It was a win-win.”

Dan Kim

Director of Operations

- Company NeedsBlue Jeans Golf was looking for a solution that bundled access to benefits with robust time-tracking software.

- SolutionsWith Justworks PEO, they were able to access competitive multi-state benefits and add employee time tracking software.

- ResultsBlue Jeans Golf saved 75% more than with their previous PEO provider with an all-in-one solution that exceeded expectations.

“The [Justworks Time Tracking] clock in, clock out app is super intuitive, whether we are transitioning a business from a 20-year-old time tracking system or onboarding a tech-first teenager.”

Michael Canfield

CFO and Co-Founder, Blue Jeans Golf

- Company NeedsTattle wanted competitive benefits offered through a user-friendly HR platform.

- SolutionsThrough the Justworks PEO platform, they were able to manage benefits and simplify onboarding and payroll processes.

- ResultsWhile access to quality benefits was the initial draw. The Justworks PEO platform, with its modern, intuitive interface, offered so much functionality, plus the support was the cherry on top.

“From onboarding new employees to employees' ability to interact with the platform on their own — it’s like night and day.”

Gary Beltrani

CEO, Tattle

- Company NeedsActerra wanted a solution with dedicated, reliable support they could turn to for HR expertise.

- SolutionsIn addition to HR, payroll, compliance, benefits access, and support, Acterra was able to add a seamless timekeeping solution.

- ResultsWith the right HR tools in place, Acterra can run more efficiently and spend more time on impactful programming.

“I think Justworks has definitely helped us run more efficiently. In an organization where we’re trying to make the world a better place, every hour and day that I can save not doing administrative work is work that we can put into our programming and help find solutions to climate change.”

Zack Wurtz

Chief of Staff, Acterra

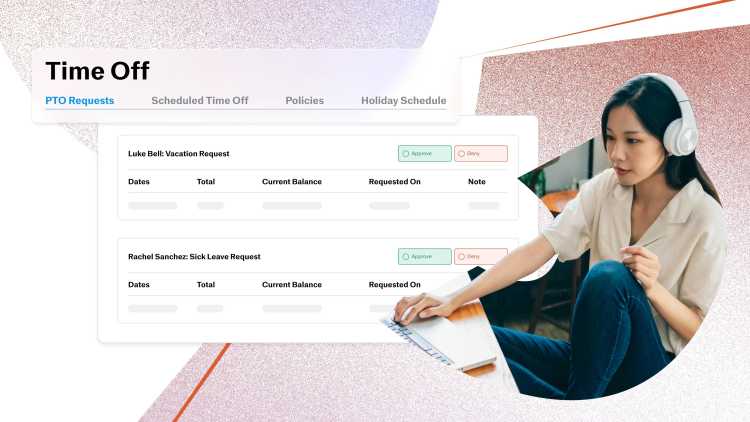

Save Time with Seamless Employee Time Tracking

Enhance time management across your team with easy-to-use employee time tracking software. With the addition of Justworks Time Tracking, you can efficiently review your team’s hours, ensuring payroll is accurate and timely. Reduce your risk of errors with safeguard features that ensure hours are being reported correctly and your business remains compliant. Whether your team is remote or on-site, employees can easily and conveniently track time using our mobile app, online platform, or Slack.

Expert Full-Service Support

When you or your employees have questions, our dedicated support team can help find the answers. PEO customers can also get support from our certified HR consultants for tailored guidance and best practices on team management. Plus, we’ve also got a rich library of resources, including our Blog with tips for business owners and HR professionals, the Scoop for compliance updates, and the Help Center for guidance on our products and services.

Not Our First Rodeo

Join the thousands of small businesses that partner with Justworks to handle their payroll, compliance, benefits, HR, and more - all in one place.

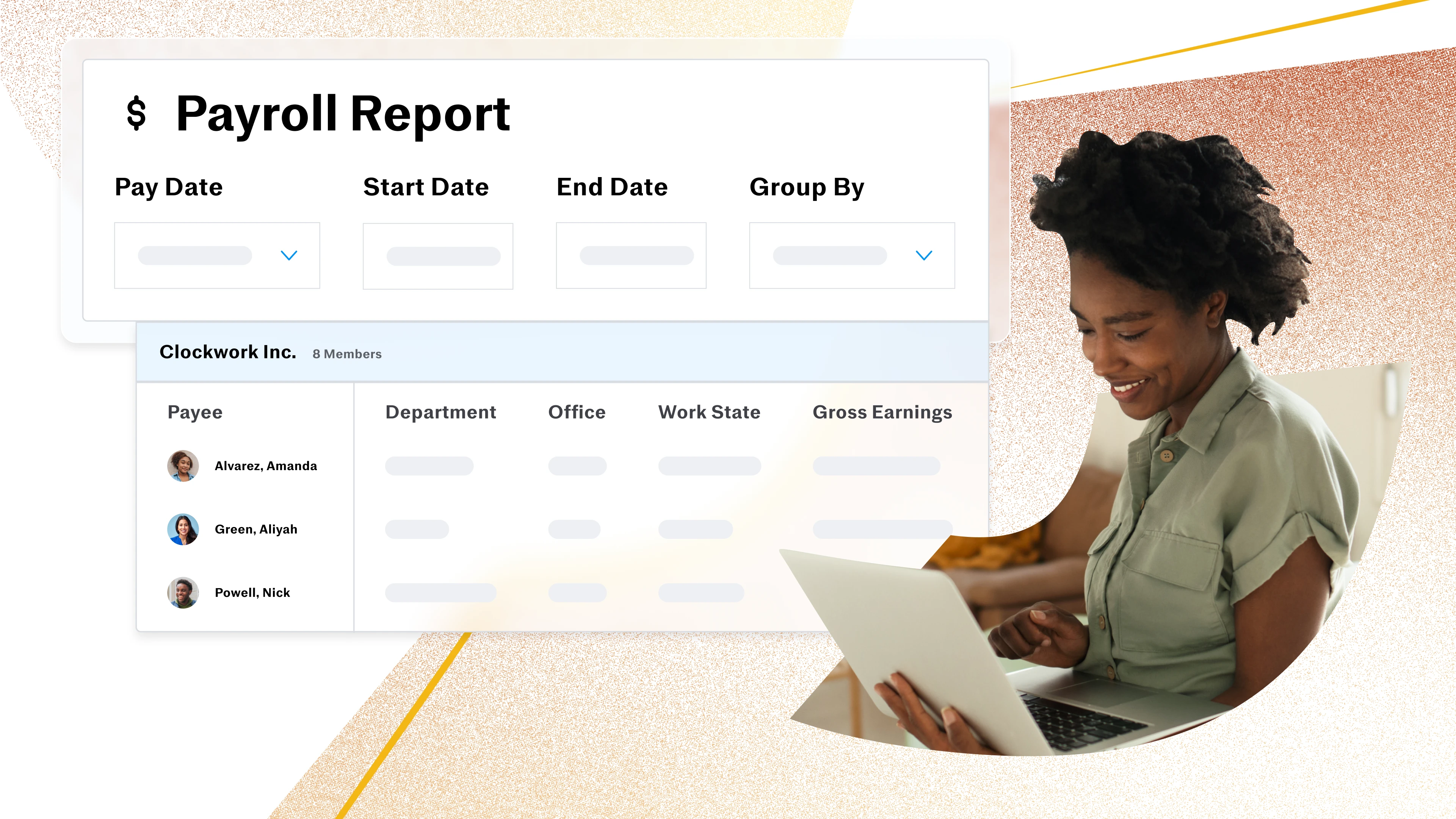

You can rely on us to help you run payroll stress-free. To put some numbers on it, we processed over $25.6 billion in payroll in 2023. In other words, we’re not new to this.

$25.6B+

Take care of your business, we’ll take care of the tax filing. Through Justworks PEO, we processed over $6 billion in federal taxes in 2023. That's $6 billion with a “B.”

$6B+

Expand in other states or hire remotely stress-free. Justworks PEO supports 2,000 tax localities which makes it easy for us to help file your employer-related taxes.

2,000

Sit back while we take care of filing W-2s and 1099s for you. We generated over 240,000 W-2s for our PEO customers in 2023. You can trust us to get the job done and get more time back for your business.

240k+

$25.6B+

$6B+

2,000

240k+

Have You Heard of Just Thrive?

We're on a mission to support minority and women-owned businesses. Ask your sales rep about Just Thrive to learn how your MWBE can access discounts on Justworks PEO.

“We're a rapidly growing small business and needed to add hourly employees to our team payroll but didn't know where to begin. Luckily we found Justworks Payroll. The interface is simple and the support is extraordinarily helpful. It's the perfect fit for a company that is not quite ready for Justworks' PEO and in need of a seamless, turnkey payroll solution.”

Kevin Lesser

Founder, Ktchn Apothecary

Ready to Get Started with Justworks?

Get more time back to focus on cultivating your employees and crushing your business goals. Together we can help you streamline your HR and admin processes.