One common type of business entity is the Limited Liability Company (LLC).

If you prefer to not be held personally liable for the actions of the business, and would like to take advantage of certain business-friendly taxes, an LLC might be the right business entity for you.

Read on to learn some of the advantages and disadvantages of an LLC.

Advantages of an LLC

There are advantages to running an LLC, especially when compared to a corporation or a sole proprietorship.

One advantage is that taxes may be passed through to the owners without taxation on the entity level if an LLC elects to be taxed as a partnership. As such, LLCs may be referred to as a “pass-through” entity. This type of business structure reduces the effects of double-taxation. Whatever the business makes in profit is allocated among the owners who are taxed at the individual level.

Related Article: Tax Tips Every Business Owner Needs to Know

Another benefit is the ability to use the cash method of accounting. With a corporation, generally the IRS requires taxes to be paid when they are earned, irrespective of whether the income is received, unless an exception applies. If an LLC has elected to be treated as a corporation, it may be able to use the cash method, so taxes are paid when revenue is received.

Finally, as with a corporation, employees and members may have protection from liability. The LLC may be liable for the actions of the LLC, but the individual members typically will not be held personally liable for actions of the LLC.

Disadvantages of an LLC

Some institutional investors like venture capital funds prefer to invest in C Corporations rather than LLCs.

There may be disadvantages. For example, LLC members pay taxes on their share of profits. Owners or shareholders of C Corporations do not have to pay taxes until dividends are distributed.

Some institutional investors like venture capital funds prefer to invest in C Corporations rather than LLCs. If you are planning to raise money from venture capital funds, an LLC may not be the best form.

While it is possible to issue equity incentives to employees in an LLC, much like a corporation would, there are some differences and may be some complications depending on the type of equity incentive.

Is an LLC Right for Me?

There are a number of questions to ask yourself when you are looking to set up an LLC. We have raised some below that may be relevant to your business.

Do I need to raise money? Be aware that some investors may prefer to invest in corporations.

Are there employees involved who will be compensated with equity? If employees may be compensated with equity incentives, there may be some complications if the entity is an LLC.

Will the LLC members benefit? An LLC is a pass-through entity, which can be advantageous for members for tax purposes. It may be important to identify whether this will be beneficial for members and business earnings.

It is always advisable to talk to a lawyer or accountant about setting up an LLC, because they can help advise you on the best type of corporate structure for your business.

While there are many tax advantages to forming as an LLC, considerations about how your business will raise money and incentivize employees may favor a different entity form.

LLC vs. C Corporations

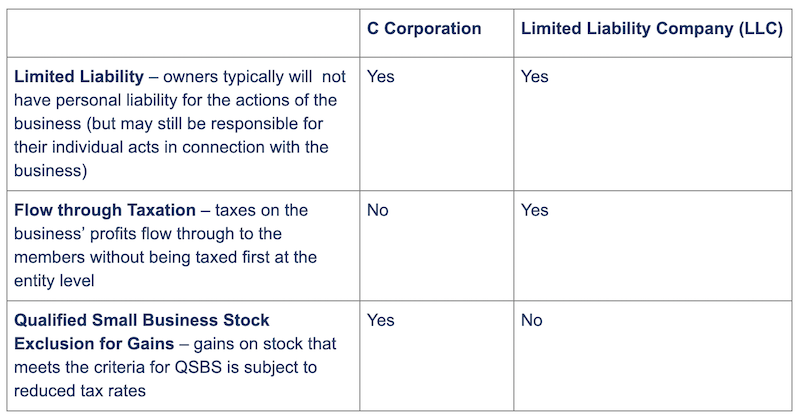

While there are many differences between LLCs and C corporations, the chart below, care of Cooley LLP, covers some of the main differences between LLCs and C corporations that you may want to consider when choosing an entity.

A number of factors should go into making the decision between an LLC and a C Corporation, and the ones listed above are only a few to consider. If you do establish an LLC, you may be able to later convert it to a corporation. However, state laws shall govern the conversion process.

Forming an LLC

If you want to form an LLC, this requires a formal process and the specifics vary by state so the below is only a general guide. There are typically costs involved in setting up an LLC, such as filing fees. However, long-term, the tax benefits may outweigh the initial cost that will come to setting up an LLC.

Related Article: 6 Small Business Tax Deductions To Remember

Get a Name

To form an LLC, you must select a name for the business. You’ll want to do your research, because if there is already an LLC in the state with the name you want, you likely won’t be able to register it. Most likely, your business name will have to include either Limited Liability Company, Limited Company, LLC, L.L.C, Ltd. Liability Company, or some other variation. Review the applicable state’s rules carefully since there may be restrictions on what you can name your LLC.

File with the State

With the name chosen, you also should draft the LLC’s Articles of Organization. Some states refer to this as a “Certificate of Organization” or “Certificate of Formation.” Whatever the name, the goal of the document is to give the basic information on the LLC. This document typically will include the name and address of the business, and in many cases, the names of all the members of the LLC.

You’ll likely have to submit your business’s name and the Articles of Organization to your Secretary of State, along with the name of your registered agent. A registered agent is someone who will receive any legal documents. There will also be a fee associated with filing.

Create an Operating Agreement

An LLC Operating Agreement typically will include information about how the business will be managed, who owns how much of the business, and other governing rules.

The operating agreement also may describe your business. It’s an agreement among the members of the LLC that, among other things, may define what the business is, how the business is run, where it is run, who owns what, and how many things will get done.

Some important things that typically are included in an operating agreement are:

Who the members are

How the profits and losses will be distributed

What the LLC management team will be

Whether the members or board of managers will manage the company

Each member’s percentage of the LLC

Any money that the members put into the business

What happens if a member wants to sell his/her share or dies

The voting powers of each members and how votes will be held

Publish a Notice

In some states, such as New York, in order to register an LLC, you need to notify your local area that you are operating as an LLC. You may be required to do this by publishing announcements or notices in newspapers. Failure to do so may carry a penalty or may result in the suspension of an LLC’s registration.

Get Licenses and Permits

New LLCs will likely need to obtain the required licenses, accounts, and permits. These may include a business license or tax registration certificate, a federal employer identification number (EIN), a sellers' permit, a zoning permit, and any others that apply to your business.

Learn more with Justworks’ Resources

Scale your business and build your team — no matter which way it grows. Access the tools, perks, and resources to help you stay compliant and grow in all 50 states.