It’s a moment business leaders dread — terminating an employee can be a complicated and emotional process for both parties involved.

The way you terminate an employee sets precedent for the rest of the company — it indicates to your remaining employees your level of tact, compassion, and professionalism.

That’s why setting the right tone when terminating an employee is important for company morale. How can you do this? Practicing what you’ll say and doing so in a private space are just one of many ways to keep the termination process smooth.

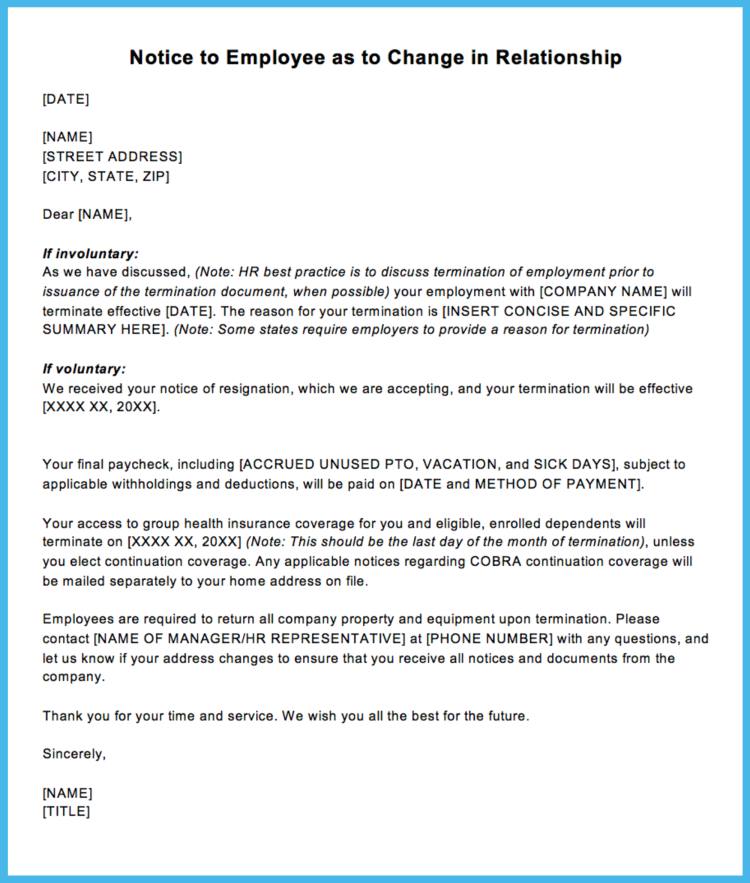

Employee Termination Letter Template

Handing the employee a termination letter after discussing their termination with them goes a long way toward being direct and clear about your decision. To help you with the process, we’ve created a termination letter template that you can download and customize.

Want to edit this in Word? Download the letter template here.

Please note that this sample termination letter assumes no severance is being paid. If severance is being paid, you should consider using a separate agreement.

Termination and Employment Laws

Be sure to determine what is required to be paid under company policies and applicable law, keeping in mind that employment laws vary from state to state. It’s best to consult with counsel to ensure compliance with applicable laws.

Termination of employment is never easy. But being prepared with tools like a termination letter can at least make it a little simpler.

For additional insights on how to handle thorny topics, download our free eBook for business leaders.

Learn more with Justworks’ Resources

Scale your business and build your team — no matter which way it grows. Access the tools, perks, and resources to help you stay compliant and grow in all 50 states.