A PEO can be incredibly helpful to small- and medium-sized companies. Learn more about how a PEO can benefit your small business, and download our free ebook on the advantages of a PEO.

What Is a PEO?

The acronym PEO stands for Professional Employer Organization. Professional Employer Organizations work with small businesses to help them manage payroll, certain human resources functions, access to benefits, and other employer-related administrative functions necessary to running a business. This allows you to focus on what matters most: growing your business.

What business functions do PEOs support? Here are a few examples of what PEOs will be able to help with:

Payroll

Think automated deposits, one-off payments, and more. PEOs help administer payments to full-time and part-time employees (salaried and hourly), and sometimes vendors and contractors as well. In sum, they handle the nitty gritty of payroll administration.

Looking for software to streamline your payroll? Check out our Payroll features here.

Benefits

PEOs help with different types of benefits administration, such as benefits onboarding, claims, and other benefits-related paperwork.

They can help you access medical, dental and vision coverage for your team at affordable rates. That’s because the PEO model typically aggregates the employees of many small businesses together to harness the buying power normally reserved for much larger businesses.

Interested in offering high-quality health insurance and modern benefits? Check out Justworks Benefits here.

Compliance Support

A PEO will support your employer-related compliance needs.

Compliance support that Professional Employer Organizations offer includes:

New hire reporting

Workers’ compensation & EPLI coverage

Employer payroll tax filings (940 and 941)

W-2 and 1099 filings

Modern Health, Wellness, and Additional Perks

Many PEOs also provide access to additional perks for their customers. These can include access to 401(k) and wellness services like mental health support, women’s health and family planning, primary care, and care navigation services. PEOs can also provide access to retirement savings plans like 401(k)s to support employees’ financial security.

Another common perk is access to commuter benefits, which allows employees to use pre-tax dollars for transportation costs. Whatever perks a PEO provides, they are generally aimed at fostering healthy, happy teams and helping employers create great places to work.

How Does a PEO Work?

PEOs can take on such responsibilities for you because of a practice called co-employment.

According to the National Association of PEOs, co-employment is “a contractual allocation and sharing of certain employer responsibilities between the PEO and the client.”

PEOs help small businesses access top-notch benefits and assist them with various compliance needs.

The contract between your business and a PEO distributes the employer responsibilities. By this contract, a PEO as employer of record will handle payroll administration and related tax filing, and provide HR support and access to benefits, while your company retains responsibility for day-to-day operations and management of your company’s employees. Through this sharing of employer responsibilities, your company can leverage economies of scale.

What are the Benefits of a PEO?

Although it is up to each individual to decide if a PEO will be a good fit for their company, there are a few advantages that PEOs can bring to your business.

Cost Savings on Employee Benefits

By working with a PEO, employees are grouped together with the rest of the PEO’s co-employees to form one large group. This means that the PEO can provide the employees access to health coverage and rates on par with those of a large corporation, even though they work for a much smaller operation.

Supporting Remote Teams

A PEO can support remote teams in a few fundamental ways. First, PEOs can assist employers with meeting employment-related compliance obligations, including payroll and related tax filings, and obtaining workers’ comp and state unemployment insurance.

PEOs can also keep your business informed of important federal and state labor laws that affect you if you have a remote workforce. Hiring in new states, or managing employees if they move to different states than where your business is located, means your business will need to comply with laws in those states, so it’s helpful to have a provider to help you navigate these tax and employment law implications.

Secondly, a PEO connects your employees to the resources they need to stay happy and healthy in a remote work environment. For instance, Justworks provides top-quality wellness and mental health benefits through Talkspace, Peloton, and Kindbody.

Offering access to these types of modern benefits helps ensure that employees feel taken care of throughout their remote work experience.

Cost Savings through Hiring

Because a PEO will help you manage a lot of your employment-related paperwork for you, as well as provide HR support, most companies can delay making hires to handle this in-house. When your business does make an HR hire, utilizing the the PEO’s tools can help free that person’s time to focus on making your company an amazing place to work.

Protect Against Risk

Many start-ups and small businesses get fined every year for making payroll mistakes.

And that's just for payroll! The reality is that compliance can be complicated and there is lots of paperwork to file and insurances to secure. While you can do this on your own, you probably didn't start your company to become a compliance expert and the cost of getting things wrong can be pretty high.

PEOs are experts on employment-related compliance. They know the paperwork you need to file and, in certain cases, they can file it for you.

Get Hours Back in Your Day

Running your own business can sometimes be a race against the clock. There's always more to do and not enough hours in the day to get it done. If you join a PEO though, there's a lot they can take on from you when it comes to employment-related administrative work, which can often mean getting multiple hours back every day or week.

What a PEO Doesn’t Do

Clearly PEOs can alleviate a lot of a business’s administrative HR burden. But they can’t do it all. It’s important to note what a PEO generally will not do.

First, although co-employment allows the PEO to take over many responsibilities for their customers, they won’t take over the running of your business. It remains up to each employer to manage their team and their operations.

Also, as a general rule, PEOs aren’t legal or tax advisors. While they can help with any number of forms and filings, as well as support, each company still needs to be familiar with the laws applicable to their business and be responsible for compliance.

How Much Does a PEO Cost?

The cost of a PEO is an important consideration for any small business. The way that a PEO makes money is by charging you to handle these services. Many companies charge per employee while others might charge a percentage of total gross payroll. So if they charge $100 per employee per month and you have a 25-person team, you’ll be paying $2,500 per month, or $30,000 a year.

At Justworks for example, our monthly fee depends on how many employees you have. Customers often save hundreds per month by getting access to less expensive employee benefits.

What is a Certified PEO?

The Internal Revenue Service (IRS) established a voluntary certification program for professional employer organizations in 2014. Recognized under the Small Business Efficiency Act, a Certified Professional Employer Organization (CPEO) is subject to stringent operational and financial standards. CPEOs are subject to ongoing bonding, audits, and IRS reporting.

In addition to this financial oversight and security, CPEO customers are entitled to various employment- and payroll tax-based federal tax credits, such as the R&D payroll tax credit. These businesses are also not required to restart federal payroll tax wage bases when joining or leaving a CPEO in the middle of a calendar tax year. In other words, CPEO customers worry less and benefit more.

*Required IRS disclaimer: The IRS does not endorse any particular certified professional employer organization. For more information on certified professional employer organizations, please visit www.IRS.gov.

Justworks Can Help

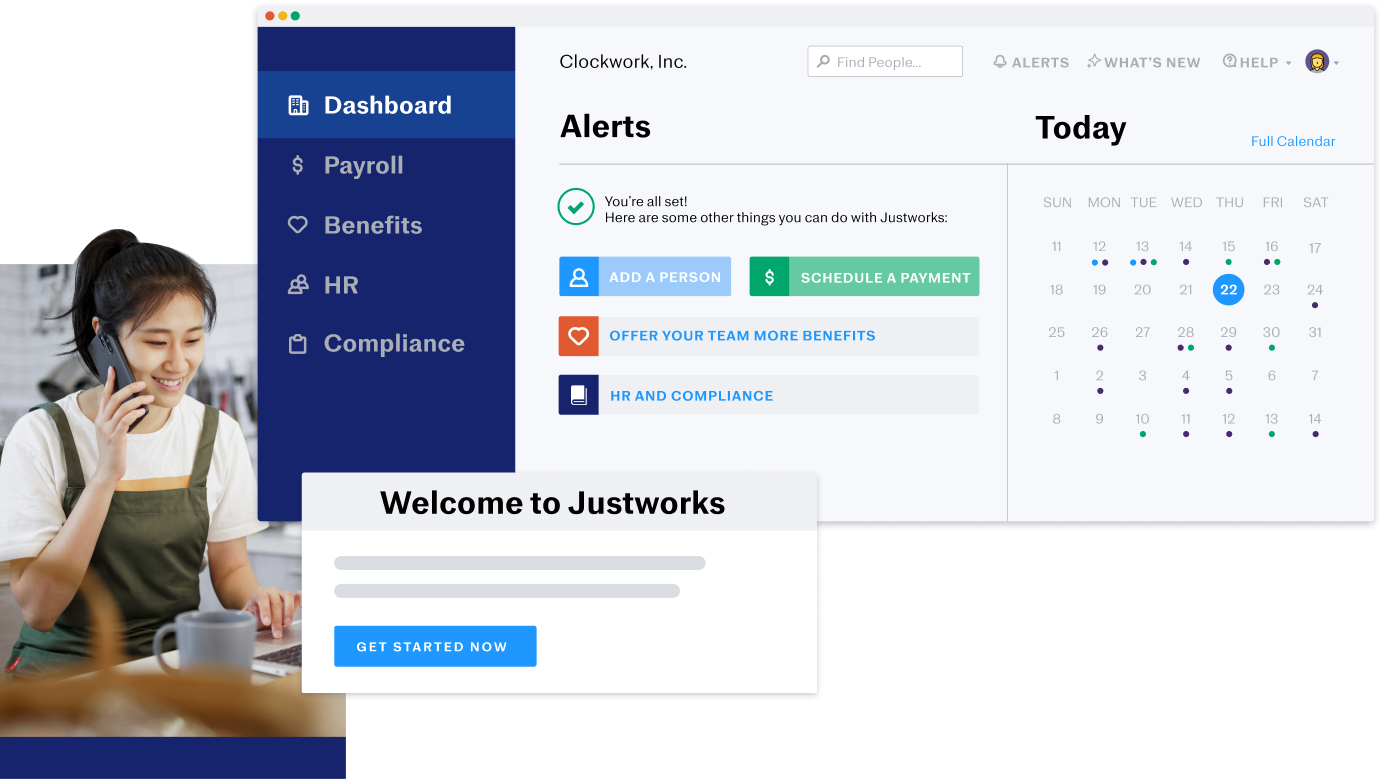

Like other PEOs, Justworks PEO will help you save significantly on employee benefits, automate your payroll, and help with certain employment-related compliance. Unlike other PEOs though, we've gone out of our way to build amazing software, with fair and transparent pricing.

Our customers work at fast-moving companies where they don't want to have to call somebody every time they need to add a dependent to their benefits policy, or add someone to payroll. To service them best, we've built simple, fast, and automated software they can access online on their computer or on their phone and manage tasks as they need.

If your company is ready to save time and money by working with Justworks PEO, contact us today.

Learn more with Justworks’ Resources

Scale your business and build your team — no matter which way it grows. Access the tools, perks, and resources to help you stay compliant and grow in all 50 states.